Investment

Investment

zuarimoney.com

facilitates investment advisory & offers financial products & services from leading

Banks / NBFCs / Mutual Funds / Insurance companies* / Stock Exchanges / Realtors,

all under one roof, such that employees need not deal with multiple people for meeting

their financial requirements.

The employee benefit initiatives enhance employee productivity, as multiple financial

/ investment requirements are serviced at a single point of contact by a professional

and reliable entity. Hence, employees need not invest work hours in evaluating various

products / companies to meet their basic financial / investment needs.

(*Zuari Insurance

Brokers Ltd.)

|

|

National Pension System, popularly known as NPS is a Contribution based Voluntary

Pension System introduced by Govt of India in 2004 for all Central Govt Employees

and was thrown open to all citizens of India from May1, 2009 to take care of all

your pension and retirement needs.

|

FAQs (Frequently Asked Questions)

|

What is NPS?

What is NPS?

|

|

National Pension System (NPS) is India’s simplest and perhaps the least cost pension

system. National Pension System (NPS) was introduced by theCentral Government on

01 Jan 2004, and On 1st May 2009 National Pension System was extended to all citizens

of India on a voluntary basis. NRIscan also apply. On registration to the NPS, the

subscriber will be issued a Permanent Retirement Account Number (PRAN) by the Pension

FundRegulatory and Development Authority (PFRDA).

|

What are the Tax Benefits of investing in NPS?

What are the Tax Benefits of investing in NPS?

|

NPS Contribution is exempt from tax under Sec 80C within the overall limit of Rs.

1 lakh.

For corporate employees, additional Tax Exemption limit of an amount equivalent to

10% of Basic Salary over and above the current limit of Rs. 1Lakh under Sec 80C

is available.

This additional tax exemption was introduced post the Union Budget 2011-12, wherein

special tax treatment has been given to NPS contributions byemployees of corporates.

Employer can deduct and contribute to employee’s NPS account up to 10% of Basic

salary. The entire amount socontributed will be exempted from tax under Sec 80CCD-2.

|

What are the Fund Management Charges of Pension Fund Managers?

What are the Fund Management Charges of Pension Fund Managers?

|

|

Fund management fees are enviably low at 0.25%.

|

What will happen of my funds at the time of retirement?

What will happen of my funds at the time of retirement?

|

|

You will be able to withdraw maximum up to 60% of your accumulated corpus. On the

balance amount, you will need to purchase an annuity scheme from a life insurance

company appointed by Govt. of India, which will give you monthly pension.

|

Can I opt for retirement before the age of 60?

Can I opt for retirement before the age of 60?

|

|

Yes, In Tier “1” Account, you will be required to use 80% of your savings to purchase

the annuity. You will be able to withdraw the balance 20% of your savings as a lump

sum.

|

Can I track my portfolio online?

Can I track my portfolio online?

|

|

Yes, on registration to NPS, you will receive Welcome Kit with your online login

ID and password which helps you to track your portfolio and viewyour profile online

on the CRA-NSDL site: http://www.npscra.nsdl.co.in

|

|

|

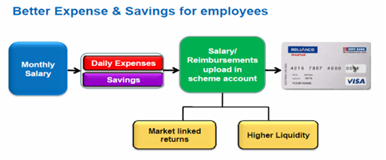

Salary Addvantage

Salary Addvantage

|

|

|

|

Salary Addvantage is designed exclusively for corporate employees for their financial

well-being, which also compliments the salary account. Conveniently transfer funds

into this account for enjoying returns generated by Liquid Funds, by submitting

one time instructions to HR Team.

|

|

|

|

|

|

|

Reliance Salary Addvantage, A unique proposition by which you could earn more out

of earing & saving both.

|

|

|

Facilities

|

|

|

|

ATM Card will be issued which will ensure its utilization as a regular bank account.

|

|

Online transactions facilitated through Invest Easy platform.

|

|

|

|

Key Features

|

|

|

|

Employees get Liquid Fund linked returns in this account

|

|

Tax Free Dividends

|

|

Shopping at all POS Terminals

|

|

Free Cash Withdrawals at all VISA enabled ATM’s

|

|

SMS & Email Alerts for every Transaction

|

|

Online Services to manage portfolio conveniently

|

|

|

|

|

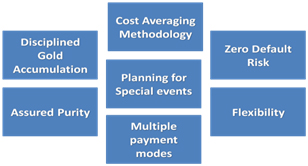

My Gold Plan

My Gold Plan

|

|

|

|

Gold Plan is a product that enables systematic purchase of gold by customers for

their personal requirements through periodic accumulations .

|

|

|

Reliance My Gold Plan offers customers the unique opportunity to start accumulating

physical gold using a daily average pricing methodology. A minimum subscription

of Rs.1000 per month translates to accumulation of gold for as low as Rs. 50 per

day.

|

|

|

|

The plan can be subscribed for a tenure ranging from 1 year to 15 years.

Customer can avail their statement of holding on a daily basis detailing the amount

of gold accumulated and the purchase price of gold in a transparent manner.

|

|

|

|

At the end of the selected term of the plan, customers have the option to exchange

their accumulated gold grams into 24 Karat gold coins or jewellery at designated fulfilment

outlets across India.

|

|

|

|

Benefits of Gold Saving

Plan at Reliance MGP

|

|

|

|

DISCIPLINED GOLD ACCUMULATION:

|

|

|

A disciplined accumulation technique under which you accumulate gold grams by making

small but regular subscriptions

|

|

|

|

COST AVERAGING METHODOLOGY:

|

|

|

All subscriptions made will be split into 20 daily purchases thus reducing the risk

of timing the markets. More Gold Grams will be credited during falling markets and

less during rising markets

|

|

|

|

PLANNING FOR SPECIAL EVENTS:

|

|

|

Plan for a large Gold purchase in the future for special events like daughter’s

wedding, your wedding anniversary or any other joyous occasions by making regular

subscriptions

|

|

|

|

ZERO DEFAULT RISK:

|

|

|

Appointment of an Independent trustee to manage the bank accounts in which Customer

funds are deposited, ensuring safekeeping of Gold by a Safekeeping agency having

insured vaults as per RBI specifications and ensuring delivery of Gold to the end

customers helps create a Zero Default risk structure.

|

|

|

|

ASSURED PURITY:

|

|

|

24 Karat Gold

of 995 fineness or more credited to the customer’s account up to 4 decimals.

|

|

|

|

MULTIPLE PAYMENT MODES:

|

|

|

Cheque/DD/Pay Order/ECS/Direct Debit

|

|

|

|

FLEXIBILITY:

|

|

|

Choice of obtaining the accumulated Gold grams in the form of coins and/or bars

across multiple outlets.

|

|

|

|

|

Insurance

Insurance

Insurance solutions are provided to individuals and corporate through ZFL subsidiary

Zuari Insurance Brokers Limited, which is registered with Insurance Regulatory and

Development Authority (IRDA). It is paramount that a corporate should be adequately

covered from all types of risks exposed. With our wide range of corporate insurance

solutions we provide products and services for corporate of all sizes. Our team

of specialist underwriter’s guide corporate on a comprehensive framework for enterprise

risk management.

|

Gratuity & Leave Encashment

Gratuity & Leave Encashment

Gratuity is a defined benefit plan and is one of the many retirement benefits offered

by the employer to the employee upon leaving his job. Gratuity is a part of salary

that is received by an employee from his/her employer in gratitude for the services

offered by the employee in the company.

|

Group Term Insurance

Group Term Insurance

Group term Insurance Scheme is meant to provide life insurance protection to groups

of people. Administration of the scheme is on group basis and cost is low. Under

Group (Term) Insurance Scheme, life Insurance cover is allowed to All the members

of a group subject to some simple insurability conditions without insisting upon

any medical evidence.

Scheme offers covers only on death and there is no maturity value at the end of

the term.

|

Marine Insurance

Marine Insurance

Required by the Corporate to cover all the risks pertaining to transit of the goods

and materials under different lines of Insurance which are as under:-

-

Marine Specific Cargo/ Marine Single

Policy (Inland / Import / Export)

Marine Specific Cargo/ Marine Single

Policy (Inland / Import / Export)

-

Marine Open Policy (Inland / Import / Export)

Marine Open Policy (Inland / Import / Export)

|

Fire Insurance

Fire Insurance

Standard Fire and Special Perils Policy availed by Corporates to cover the asset against

fire & allied perils.

.

Add-On Coverages are:-

-

Earthquake

Earthquake

-

Storm, Tempest, Flood & Inundation

Storm, Tempest, Flood & Inundation

-

Riots, Strikes & Malicious Damage

Riots, Strikes & Malicious Damage

-

Terrorism

Terrorism

|

Employee Benefit Insurance

Employee Benefit Insurance

-

Group Health Insurance (GHI)

Group Health Insurance (GHI)

Group Health Insurance provides pre-defined insurance coverage’s to all employees

& their dependents for expenses related to hospitalization due to illness, disease

or injury. In the event of hospitalization claim (where admission are more than

24hrs), the payment made by the insurance company would fall under different heads

mentioned below, but not exceeding the sum insured in aggregate as per the policy:

-

Room Charges

Room Charges

-

Nursing Expenses

Nursing Expenses

-

Surgeon, Anesthetist, Medical Practitioner, Consultant , Specialists Fee, Anesthesia

, Blood, Oxygen, Operation Theatre Charges, Surgical

Appliances, Medicines & Drugs’ , Medical Test & Similar Expenses.

Surgeon, Anesthetist, Medical Practitioner, Consultant , Specialists Fee, Anesthesia

, Blood, Oxygen, Operation Theatre Charges, Surgical

Appliances, Medicines & Drugs’ , Medical Test & Similar Expenses.

-

Group Personal Accident Insurance Policy (GPA)

Group Personal Accident Insurance Policy (GPA)

GPA offer benefits like accidental death cover, disability cover, children’s education

allowance and more. This policy covers the insured "on anywhere in the world" basis.

-

Group Term Life Insurance Policy (GTL)

Group Term Life Insurance Policy (GTL)

GTL provides life insurance protection to a group of people. It provides low-cost

protection to employees. Amount of coverages is typically 5 to 10 times of the employee’s

annual salary. Under this Scheme, life insurance cover is extended to all the members

of a group subject to insurability conditions,with or without any medical evidence.Coverage

usually ends when the employee leaves the company. Scheme offers to coverdeath only

and there is no maturity value at the end of the term.

-

Gratuity & Leave Encashment

Gratuity & Leave Encashment

Gratuity is a defined benefit plan and is one of the many other retirement benefits

offered by the employer to the employee. Gratuity is a part of salary that is received

by an employee from his/her employer in gratitude for the services offered by the

employee in the company.

|

Liability Insurance

Liability Insurance

-

Product Liability

Product Liability

This policy covers all sums (inclusive of defence costs) which the insured becomes

legally liable to pay as damages as a consequence of:

-

Accidental Death/ Bodily Injury or Disease to any third party.

Accidental Death/ Bodily Injury or Disease to any third party.

-

Accidental Damage to property belonging to a third party.

Accidental Damage to property belonging to a third party.

Arising out of any defect in the product manufactured by the insured and specifically

mentioned in the policy after such product has left the insured's premises.

-

Directors & Officers Liability Insurance

Directors & Officers Liability Insurance

D & O liability insurance protects past, present and future directors and officers

of companies (Listed and Non-Listed) from damages resulting from alleged or actual

wrongful that acts Director and Officer’s may have committed in their positions.

The policy provides protection in the event of any actual or alleged error, misstatement,

omission, misleading statement, or breach of duty.

-

Commercial General Liability

Commercial General Liability

Commercial General Liability (CGL) policy covers third party liabilities arising

from various business operations, be it premises, products and completed operations

and/or advertising and personal injury.

-

Public Liability Insurance

Public Liability Insurance

This policy covers the amount which the insured becomes legally liable to pay as

damages to third parties as a result of accidental death, bodily injury, loss or

damage to the property belonging to a third party.

|

Travel / Overseas Medi-claim Insurance

Travel / Overseas Medi-claim Insurance

Corporate can avail overseas Medi-claim / travel policy to meet any exigencies during

an overseas travel by the employee. Depending on the policy the travel insurance

can cover following expenses:

- Medical expenses

- Trip cancellations

- Loss of travel equipments

- Damage to rental properties

- Theft

- Legal expenses

|

Project Insurance

Project Insurance

-

Construction All Risk Policy

Construction All Risk Policy

This policy is specially designed to give financial protection to the Civil Engineering

Contractors in the event of an accident to the civil engineering works under construction.

-

Industrial All Risk Policy

Industrial All Risk Policy

Industrial All Risks Insurance provides financial compensation against accidental

loss or damage to your plant, machinery, stock and building and against loss for

consequential business interruption.

-

Storage Cum Erection Policy

Storage Cum Erection Policy

Erection All Risks (EAR) policy is designed to cover Plant and Machinery under erection.

This policy provides comprehensive covers for risks associated with storage, assembly/erection

and testing of Plant and Machinery.

-

Contractor's Plant & Machinery Policy (CPM)

Contractor's Plant & Machinery Policy (CPM)

This policy covers different types of infrastructure machinery / equipment used

for handing material or construction like movable plant and machinery owned or leased

by the principals or contractors and used on site for various construction work,

repairs & maintenance jobs or even regular site work.

-

Stock Insurance

Stock Insurance

This policy covers fire and special peril along with STFI & Earthquake. A separate

burglary cover can also be taken to insurance against theft and burglary for property

contained in business premises.

|

Shopkeeper’s / Merchant Cover

Shopkeeper’s / Merchant Cover

It's a package policy, in this building, stocks and other miscellaneous contents

/ assets kept in the shop can be are covered for Fire, Burglary, earthquake, act

of god, public liability, etc.

|

Project / Business Loans

Project / Business Loans

As a mortgage distributor, Zuarimoney represents all leading Banks / NBFCs and provides

an end to end mortgage solution that best fits the customer’s fund requirement.

Zuarimoney provides end – to – end solutions for :

-

Home Loan

Home Loan

-

Plot Loan

Plot Loan

-

Loan against Property

Loan against Property

-

Lease Rental Discounting

Lease Rental Discounting

-

Commercial Loan for Small and Medium Enterprises(SME)

Commercial Loan for Small and Medium Enterprises(SME)

|

Project Loan

Project Loan

With specialized services related to purchase of property, documentation & assisting

the Investor with Loans, ZIL caters to customers’ real estate investment requirements.

The professional services are extended for direct purchase with developers of repute

and proven track record.

-

Residential Property

Residential Property

-

Commercial Property

Commercial Property

|

Business Loan

Business Loan

With specialized services related to purchase of property, documentation & assisting

the Investor with Loans, ZIL caters to customers’ real estate investment requirements.

The professional services are extended for direct purchase with developers of repute

and proven track record.

-

Residential Property

Residential Property

-

Commercial Property

Commercial Property

|