|

|

|

|

|

|

This loan is availed to purchase a residential property. The property can be Flat,

Bunglow, Row House from a Private Developers or Approved Projects. The home loan

may be availed for buying a new residential house or resale of residential house.

|

|

|

|

|

|

|

|

|

Features

|

|

|

- The maximum period of repayment of a loan can be up to 20 years

- To increase the borrowing capacity, co applicants can be added

- Floating and fixed interest rate are offered in Home Loan

- Customised Repayment Option

- No Foreclosure Charges

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project loans means requirement of funds for the new venture, which is based on

the profile and experience of the customer and the viability of the project.

|

|

|

|

|

|

|

|

|

|

- • Project loan will be offer for the establishment for the new industries

- • The tenor of the loan is 3-5 years (depend on policy of different financers)

- • Loan offered to self employed and self employed professional only

|

|

|

|

|

|

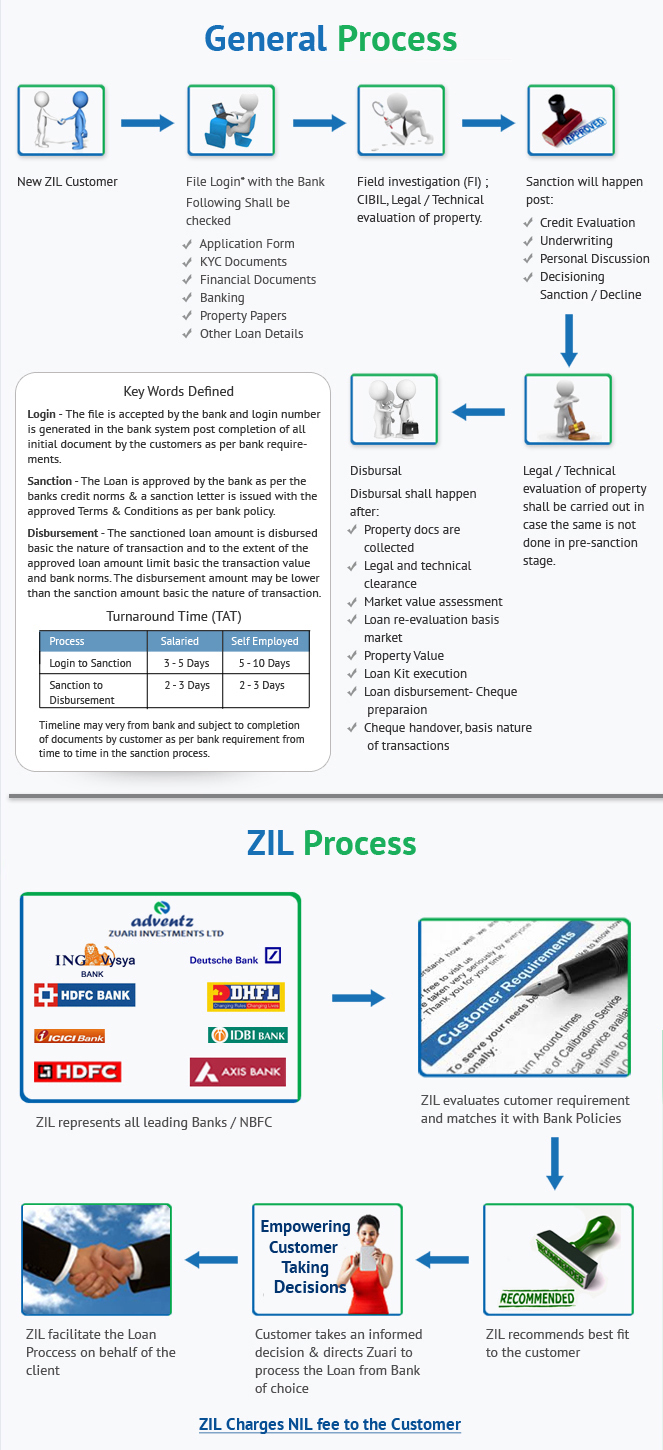

As a mortgage distributor, Zuarimoney represents all leading Banks / NBFCs and provides

an end to end mortgage solution that best fits the customer's fund requirement.

|

|

|

|

|

|

|

|

|

|

- • Convenience of contacting us through SMS, Toll Free Number and across all Branches.

- • Business Loan eligibility online & across all branches.

- • Self employed customers get exclusive higher loan amount.

- • Best in class offerings on loan amount, interest rates and charges.

- • Maximum tenor is 3-5 years (depend on policy of different financers).

|

|

|

|

|

|

For all those times when you need access to funds quickly and discreetly- a Personal

Loan is your answer.Personal loans are no questions asked unsecured loans given

to individuals on the basis of their profile only i.e. income, nature of employment,

years of work experience etc. Such loans, unlike property based loans or car loans

do not require the borrower to give any kind of security or collateral to the bank.

|

|

|

|

|

|

|

|

|

|

- • Highly competitive personal loan interest rates

- • Special offers, interest rates and charges.

- • Special personal loan offers* for women employees.

- • Personal loan offers to salaried class only

- • Maximum tenor is 3-5 years (depend on policy of different financers)

|

|

|

|

|

|

As a mortgage distributor, Zuarimoney represents all leading Banks / NBFCs and provides

an end to end mortgage solution that best fits the customer's fund requirement.

|

|

|

|

Features

|

- Dedicated and Qualified team for Personal Assistance.

- Nil charges / fees by zuarimoney.

- Compare and avail most competitive interest rates

- Avail loans for salaried, self-employed and NRI’s

|

|

|

Product Range

|

- Home Loan - To purchase Residential Property

- Plot Loan - To purchase Residential Plots

- Loan Against Property - To pledge existing freehold Commercial / Residential property

in order to raise funds.

- Lease Rental Discounting - It is a term loan offered against rental receipts derived

from lease contracts with tenants.

- Commercial Property Loan - To purchase a commercial property

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FAQs (Frequently Asked Questions)

|

LOAN BASICS

LOAN BASICS

|

What is the maximum amount I can get as Home Loan ? What is the maximum amount I can get as Home Loan ?

|

|

Maximum of Rs.15 Crore as Home Loan for self-employed customers and up to Rs.10

crore for salaried customers basis of KYC norms, Income norms and other criteria

met.

|

How do you determine my eligibility for a loan

and the loan amount ? How do you determine my eligibility for a loan

and the loan amount ?

|

We consider the following factors to determine eligibility and loan amount:

- Age

- Income

- Valuation of Property (Fair market value)

- Existing obligations, if any

- Stability / continuity of employment / business

|

Can I get approval for home loan without finalizing on my property ? Can I get approval for home loan without finalizing on my property ?

|

|

Yes, based on your income eligibility, in-principle approval for your Home Loan can be offered. Based on this, you can identify the property you need to buy. The final sanction of your Home Loan will be based on the assessment of the identified property.

|

What is the maximum tenor that I can get for my Home Loan ? What is the maximum tenor that I can get for my Home Loan ?

|

|

Maximum repayment tenor of up to 20 years for Self Employed customers and up to 25 years for salaried customers.

|

How is the interest calculated on my Home Loan ? How is the interest calculated on my Home Loan ?

|

|

The interest is calculated on monthly reducing balance at the prevailing rate of interest of your loan.

|

Can NRI avail Home Loan ? Can NRI avail Home Loan ?

|

NRIs too can avail home loans for purchase of residential property. They can purchase

a house and can even take loan for self-construction on a plot and also for renovation / improvement

of an existing residential property in India.

Like resident Indians, NRIs can avail up to 80-85 per cent of the cost of residential

property as a home loan. However, the down payment should be directly remitted from

abroad through normal banking channels or from non-resident external (NRE) account

and / or non-resident (ordinary) (NRO) account in India. EMI payments too should be

remitted from any of these accounts.

|

|

Interest Rates Interest Rates

|

|

The amount charged by the lender on the amount lend to the borrower on regular intervals

is called interest.

|

|

LOAN REPAYMENT & PREPAYMENT

LOAN REPAYMENT & PREPAYMENT

|

What the Repayment Options on loans? What the Repayment Options on loans?

|

You can choose among the following options to repay your loan: ?

- • Post Dated Cheques(PDCs)?

- • Electronic Clearing System (ECS)?

- • Standing Instructions on your banking

account if you have an account with the lending bank Some banks, specially nationalized

ones allow the borrower to make loan payments above a certain minimum limit on a

random basis

|

What are the different payment options for a Home

loan on a property that is under construction? What are the different payment options for a Home

loan on a property that is under construction?

|

|

The repayment modes remain the same however; you have the option of paying either

pre EMI (interest on the amount of loan disbursed thus far) or full EMI during this

period.

|

What is an application fee? What is an application fee?

|

|

Most lenders charge an application fee for processing the loan. This can vary from

0.5% to 2% of the loan amount and varies from lender to lender. This fee is charged

to cover the expenses of processing a loan application. It is possible that a lender

may still charge this fee even I the application gets rejected. Usually, this fee

is either deducted from the loan disbursal amount or the borrower pays it separately

through a cheque.

|

What is a Prepayment fee? What is a Prepayment fee?

|

|

Prepayment fees or prepayment penalties are charged by lenders when the borrower

chooses to pay-off the loan prior to the agreed tenure. This is due to the fact

that the lender loses interest income for the period that was remaining on the loan

and hence they charge the borrower a penalty for pre-paying. This also acts as an

exit barrier for the borrower if he wants to transfer the loan to another lender

for availing better terms. Most lenders, who allow partial payments on their loans,

set an annual limit for such payments beyond which the pre-payment penalty applies.

|

What is the conversion fee from a fixed rate of

interest to a variable rate or vice versa? What is the conversion fee from a fixed rate of

interest to a variable rate or vice versa?

|

|

This fee is at the discretion of lender. On paying a switching fee, you have the

option of changing your interest type from Fixed to Variable or vice-versa.

|

Other Specific fees on Home loans? Other Specific fees on Home loans?

|

|

Some Home Loans may have the following charges attached to them: Commitment Fees:

Some banks levy a commitment fee in case the loan is not availed of within a stipulated

period oftime after it is processed and sanctioned. Stamp duty charge: Some banks

pass on the stamp duty charges to the borrower for executing the loan agreement.

Interest Tax: is the tax payable on the interest paid on a home loan and not the

principal. This tax is some times included in the interest rate of the loan, or

may be charged separately as interest tax.

|

|

LOAN APPLICATION & PROCESSING RELATED

LOAN APPLICATION & PROCESSING RELATED

|

What is s Co-Applicant? What is s Co-Applicant?

|

|

A Co-Applicant(s) is a co-borrower to the loan and his/ her income and obligations

are factored into the loan eligibility calculation. This is usually applicable in

only secured loans. However all co-applicants need not be co-owners of properties

in the case of property backed loans.

|

Who can I include as Co-applicants of the home

loan? Who can I include as Co-applicants of the home

loan?

|

|

You can include your immediate relatives (spouse, parents, or children) as co-applicants

on the loan. Siblings can be co-applicants if they are co-owners to the property.

You also have the option of including proprietor concerns, partnership firms, private

limited companies, and closely held limited companies as co-applicants. Maximum

number of co-applicants for purpose of income clubbing is two to four (varies from

lender to lender).

|

Can I take a Home Loan for a property in a city

other than where I live? Can I take a Home Loan for a property in a city

other than where I live?

|

|

Yes, you can take loan for construction in one city while working in another. The

banks usually service this loan after getting details of the plot legally verified.

|

What is the normal turnaround Time for loan sanction

and loan disbursal? What is the normal turnaround Time for loan sanction

and loan disbursal?

|

|

After you have provided all the relevant documents, you can get a sanction for the

loan within 4-7 working days, under normal circumstances. ?On an average, loans

are disbursed within 3-15 days after satisfactory and complete documentation and

completion of all relevant procedures.

|

|

IMPLICATION OF NOT PAYING YOUR LOAN

IMPLICATION OF NOT PAYING YOUR LOAN

|

What is a default? What is a default?

|

|

Continued inability to pay your installments for any reason constitutes a default

on your loan. At this point the bank/ lender can demand a payment of the full outstanding

amount of the loan. The lender can also serve a legal notice on the borrower and

in case of secured loans, acquire the loan security (property car etc) and try to

dispose of the same to recover their money.

|

Can I get a temporary relief from paying my installments? Can I get a temporary relief from paying my installments?

|

|

Yes, in some cases you can. You need to inform your bank in advance. This should

only be for a few days and you will have to pay delayed payment charges. This will

still impact your credit rating.

|

What happens if I delay some installments? What happens if I delay some installments?

|

|

Delaying your installments frequently may affect your credit profile and might make

further borrowing not only difficult but costly too. However, in some rare circumstances,

if you delay an installment, most banks would charge you a delayed payment charge,

as high as 3%, compounded monthly.

|

|

TAX IMPLICAITON ON LOANS

TAX IMPLICAITON ON LOANS

|

What kinds of tax benefits are available on loans? What kinds of tax benefits are available on loans?

|

|

Home loan borrowers are eligible for tax benefits on the principal and interest

components of the loan under the Income Tax Act, 1961. One does however need to

keep track of the latest norms with respect to tax benefits as they keep changing.

Other types of loans such as personal loans, car loans etc are not included for

claiming tax benefits Self employed individuals and companies however may show the

interest component of their loans as an expense in their financial statements and

therefore indirectly reduce their tax liability.

|

|

INSURANCE ON LOANS

INSURANCE ON LOANS

|

What is loan insurance/ credit insurance? What is loan insurance/ credit insurance?

|

|

Most lenders offer an insurance plan covering the outstanding amount on the loan.

This is usually a depleting term plan which covers the risk of an unfortunate event

in the borrowers life that may lead to inability on the borrower or his/ her family’s

part to pay the loan installments. These are usually single premium policies taken

at the time of availing the loan. Some lenders may offer the same at a later stage

as well with coverage equal to the loan outstanding. The standard parameters such

as age, pre-existing illness, smoking profile etc still apply when calculating the

premium for such policies. When availing large loans it is often advisable that

borrowers avail of credit insurance.

|

In case of property-based loans, does the property

have to be insured? In case of property-based loans, does the property

have to be insured?

|

|

Some lenders require the property to be insured for fire and other appropriate hazards,

as required during the loan tenure. The lender will be the beneficiary of the insurance

policy. This is often an additional expense which adds to the final cost of the

property.

|

|

|

|

|

|

|

|

|

|